An Annuity Quarterly Payments Calculator helps you estimate how much income you’ll receive every quarter from an annuity contract. It removes guesswork, reduces planning errors, and helps you compare options before committing real money.

Money feels less stressful when you know exactly when it arrives. That’s why annuities remain popular among retirees, long-term planners, and conservative investors. When payments come every three months instead of monthly, planning becomes even simpler.

This guide explains how quarterly annuity payments work, why calculators matter, and how to use them correctly-without confusing jargon or unrealistic claims.

What Is an Annuity?

An annuity is a financial contract, usually issued by an insurance company. You invest a lump sum or make regular contributions. In return, the annuity pays you income later, either for a fixed period or for life.

People often use annuities to:

- Create predictable retirement income

- Reduce longevity risk

- Supplement pensions or Social Security

- Protect against market volatility

According to the U.S. Securities and Exchange Commission (SEC), annuities function primarily as income products, not growth tools. That distinction matters when you calculate payments.

What Are Quarterly Annuity Payments?

Quarterly payments distribute annuity income four times per year, usually every three months. Instead of receiving smaller monthly checks, you get fewer but larger payments.

Quarterly payouts appeal to people who:

- Budget expenses seasonally

- Prefer fewer payment transactions

- Manage business or rental income quarterly

- Want simpler tax planning

An annuity quarterly payments calculator estimates each payment based on your contract details.

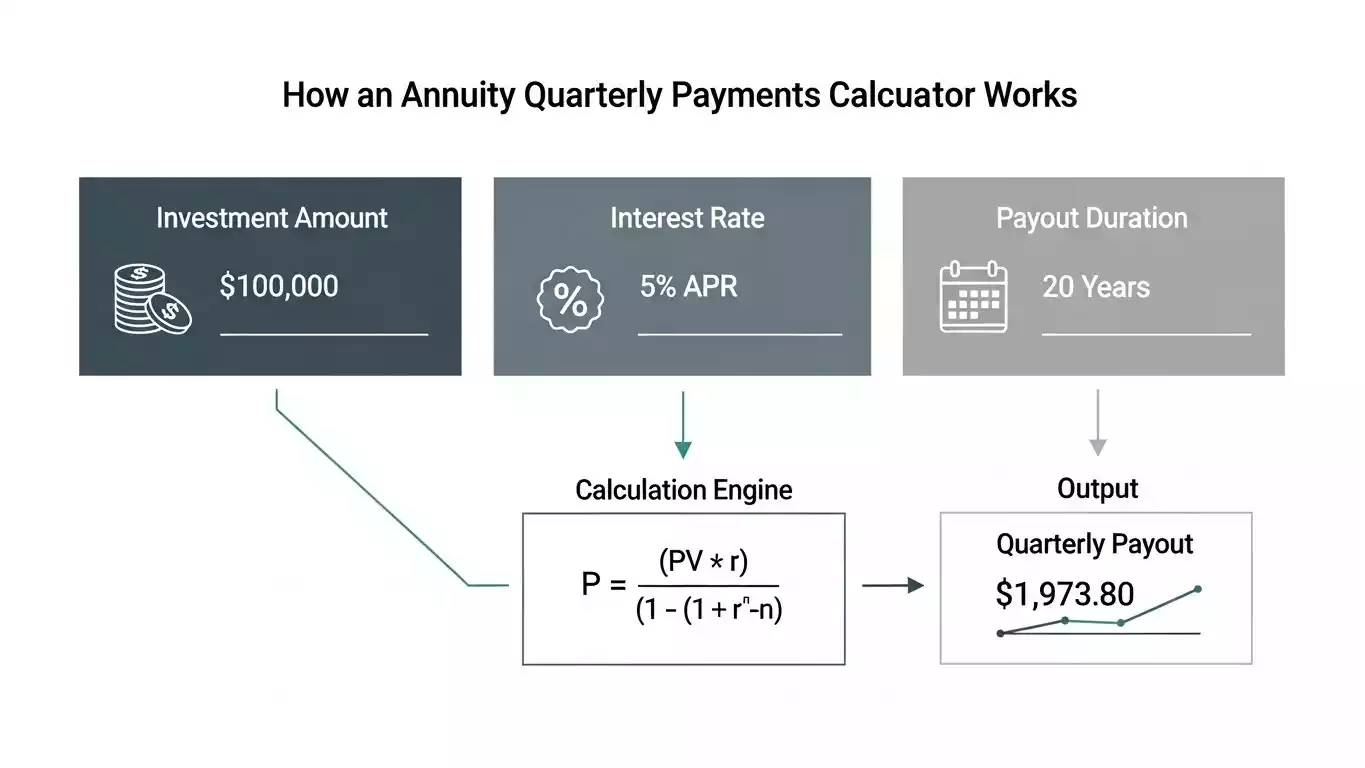

How an Annuity Quarterly Payments Calculator Works

An annuity calculator uses standard financial formulas. It does not predict markets or guarantee results. It simply calculates payouts using known inputs.

Common Inputs Used in the Calculator

Most calculators ask for:

- Initial investment amount

- Interest or payout rate

- Annuity type (fixed or variable)

- Payout duration (term or lifetime)

- Payment frequency (quarterly)

Once entered, the calculator converts annual figures into quarterly payment estimates.

No magic. Just math doing its job quietly in the background.

Fixed vs Variable Annuities: Why It Matters

Your annuity type directly affects calculator results.

Fixed Annuities

Fixed annuities provide a guaranteed interest rate. Payments stay predictable.

- Easier to calculate

- Lower risk

- Stable quarterly income

The Insurance Information Institute (III) confirms that fixed annuities offer contractually guaranteed payouts, making calculators more accurate.

Variable Annuities

Variable annuities depend on investment performance.

- Payments can change

- Higher risk

- Less predictable income

Calculators provide estimates, not promises, for variable annuities. Market returns influence real results.

Why Use an Annuity Quarterly Payments Calculator?

Manual calculations take time and invite errors. Calculators simplify everything.

Key Benefits

- Fast income projections

- Easy scenario comparison

- Better retirement planning

- Improved budgeting accuracy

- Clear understanding of cash flow

Think of it as a financial GPS. You still drive, but you avoid wrong turns.

Understanding the Quarterly Payment Formula (In Plain English)

Most annuity calculators rely on the present value of annuity formula, adjusted for quarterly payments.

Instead of calculating annual payouts, the formula:

- Divides the interest rate by four

- Multiplies the number of years by four

- Adjusts payment timing accordingly

You don’t need to memorize formulas. You just need to understand that quarterly payments slightly differ from monthly or annual ones due to compounding frequency.

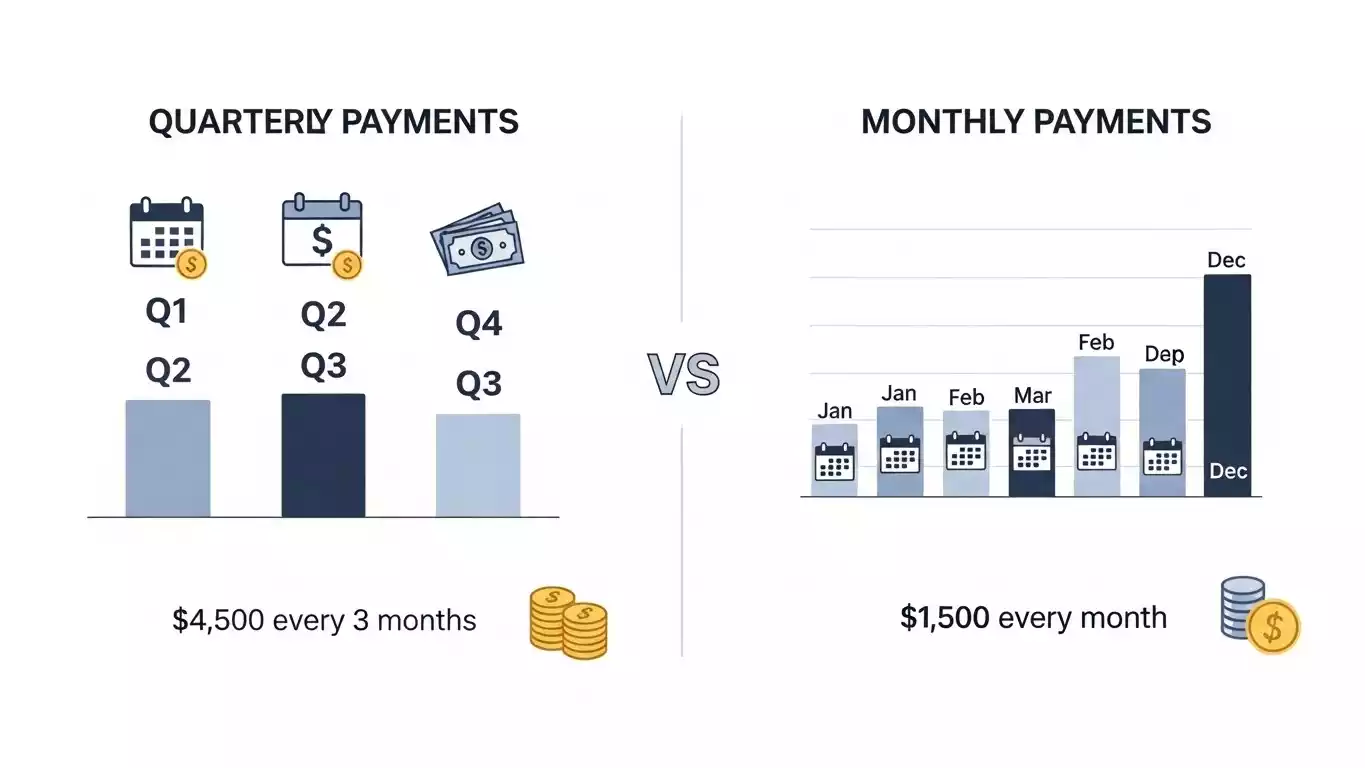

Quarterly vs Monthly Annuity Payments

Payment frequency affects income timing, not total value.

Key Differences

| Feature | Quarterly Payments | Monthly Payments |

|---|---|---|

| Payment size | Larger | Smaller |

| Frequency | 4 times/year | 12 times/year |

| Budgeting | Simpler | More frequent |

| Compounding impact | Slightly lower | Slightly higher |

According to Investopedia, payment frequency changes cash flow patterns but not necessarily long-term payout totals.

Taxes and Quarterly Annuity Payments

Taxes matter. Ignoring them leads to unpleasant surprises.

How Annuity Payments Are Taxed

- Earnings portion: taxable as ordinary income

- Principal portion: not taxed

- Qualified annuities: fully taxable

- Non-qualified annuities: partially taxable

The Internal Revenue Service (IRS) treats annuity income based on contribution type and funding source.

A calculator shows gross income, not after-tax income. Always factor taxes into real planning.

Who Should Use an Annuity Quarterly Payments Calculator?

This tool fits many financial situations.

Ideal Users

- Retirees planning steady income

- Pre-retirees comparing payout options

- Financial advisors modeling scenarios

- Business owners managing quarterly cash flow

- Investors evaluating annuity products

If income predictability matters, calculators earn their keep.

Common Mistakes to Avoid When Using Annuity Calculators

Even good tools fail when used poorly.

Avoid These Errors

- Ignoring inflation impact

- Forgetting taxes

- Assuming variable returns stay constant

- Using unrealistic interest rates

- Skipping fees and rider costs

The Financial Industry Regulatory Authority (FINRA) stresses that annuity fees affect net payouts. Always read contract details.

How Accurate Are Annuity Quarterly Payment Calculator?

Accuracy depends on input quality.

What Calculators Do Well

- Estimate fixed annuity payouts

- Compare payment frequencies

- Model payout timelines

What They Cannot Do

- Predict market returns

- Guarantee future income

- Replace professional advice

Calculators guide decisions. They don’t make them for you.

How to Choose a Reliable Annuity Calculator

Not all calculators deserve your trust.

Look for These Features

- Transparent assumptions

- Clear input fields

- No hidden promotions

- Updated interest logic

- Educational explanations

Trusted financial platforms like Investopedia, FINRA, and major insurance providers usually meet these standards.

Annuity Quarterly Payments Calculator and Retirement Planning

Quarterly income aligns well with many retirement expenses.

- Property taxes

- Insurance premiums

- Travel planning

- Healthcare budgeting

Predictable income reduces stress. Stress ages people. Enough said.

Frequently Asked Questions (FAQs):

What is an annuity quarterly payments calculator?

It’s a financial tool that estimates how much income you’ll receive every three months from an annuity contract based on your inputs.

Are quarterly annuity payments better than monthly?

Neither option is better universally. Quarterly payments suit people who prefer fewer, larger deposits. Monthly payments help with frequent expenses.

Can calculators guarantee my annuity income?

No. Calculators estimate results. Only fixed annuity contracts guarantee payment amounts.

Do calculators include annuity fees?

Most calculators do not include fees automatically. Always subtract contract fees manually for realistic estimates.

Are annuity payments taxable every quarter?

Yes, taxable portions apply to each payment period based on IRS rules.

Can I change payment frequency later?

Some annuities allow changes. Others lock frequency at annuitization. Always check contract terms.

Trusted Sources and References

To ensure accuracy and transparency, this article relies on established financial authorities:

- U.S. Securities and Exchange Commission (SEC) – Annuity basics and disclosures

- Internal Revenue Service (IRS) – Annuity taxation rules

- Financial Industry Regulatory Authority (FINRA) – Consumer guidance on annuities

- Investopedia – Educational financial definitions

- Insurance Information Institute (III) – Insurance-based annuity explanations

These sources provide industry-standard, non-promotional financial education.

Final Thoughts

An Annuity Quarterly Payments Calculator simplifies income planning without overselling promises. It helps you understand cash flow, compare options, and avoid surprises.

Used correctly, it becomes a practical planning tool-not a crystal ball.

If predictable income matters to you, calculators help you ask better questions before signing anything. And in finance, better questions often matter more than fast answers.