Managing money often feels harder than it should. You save, you invest, you plan-and still wonder if you’re doing it right. That’s where financial calculators step in. One of the most useful yet misunderstood tools is the Annuity Due Present and Future Value Calculator.

This calculator helps you understand how much a series of payments is worth today or in the future when payments happen at the beginning of each period. If that sounds confusing, don’t worry. We’ll break it down step by step-no finance degree required.

What Is an Annuity Due?

An annuity due is a series of equal payments made at the start of each payment period.

That timing matters more than most people realize.

Common Examples of Annuity Due

You’re dealing with an annuity due if you make payments like:

- Rent paid at the beginning of the month

- Insurance premiums paid upfront

- Lease payments due on day one

- Some retirement or pension contributions

In each case, money leaves your account before the period starts-not after.

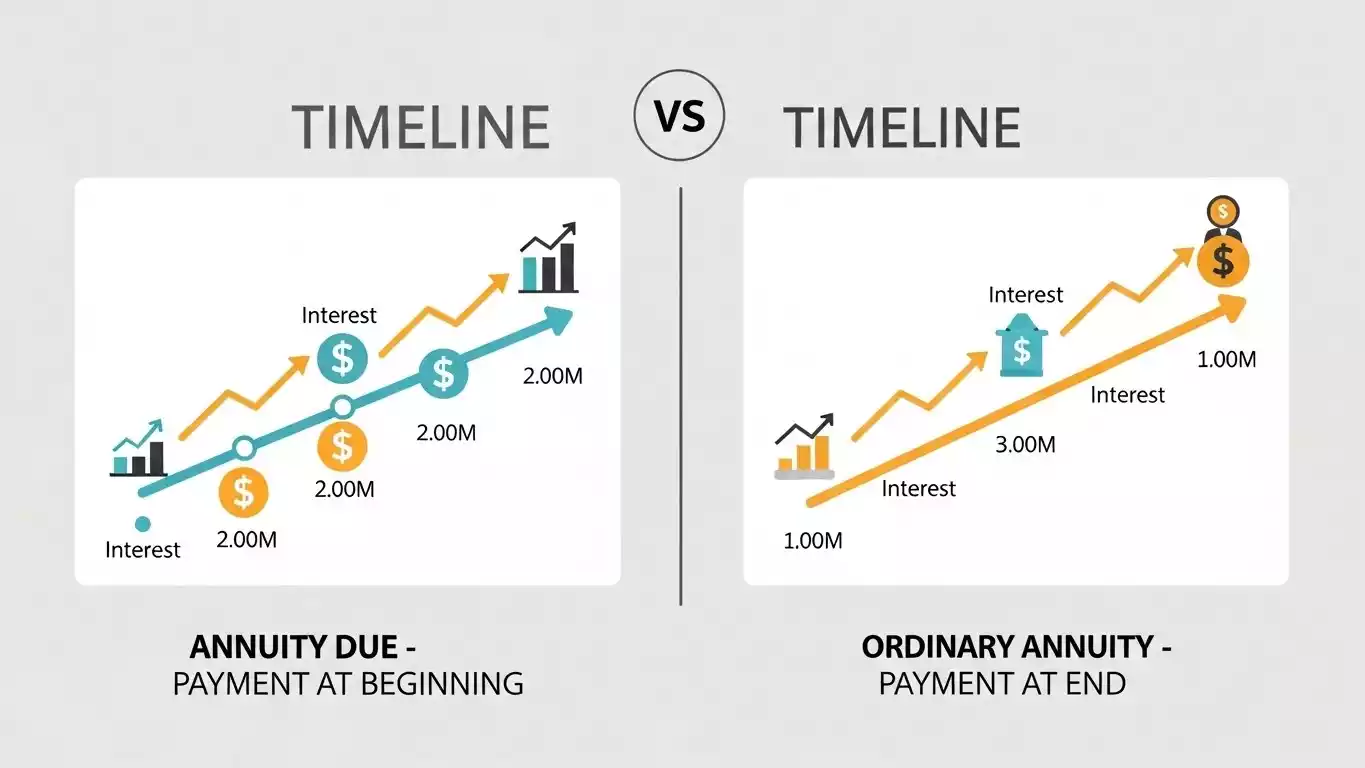

Annuity Due vs Ordinary Annuity (Quick Comparison)

People often confuse annuity due with an ordinary annuity. The difference is simple but powerful.

| Feature | Annuity Due | Ordinary Annuity |

|---|---|---|

| Payment timing | Beginning of period | End of period |

| Interest impact | Higher | Lower |

| Future value | More | Less |

Because annuity due payments start earlier, each payment earns interest for a longer time. That extra time increases the final value.

Money loves time. Even one period makes a difference.

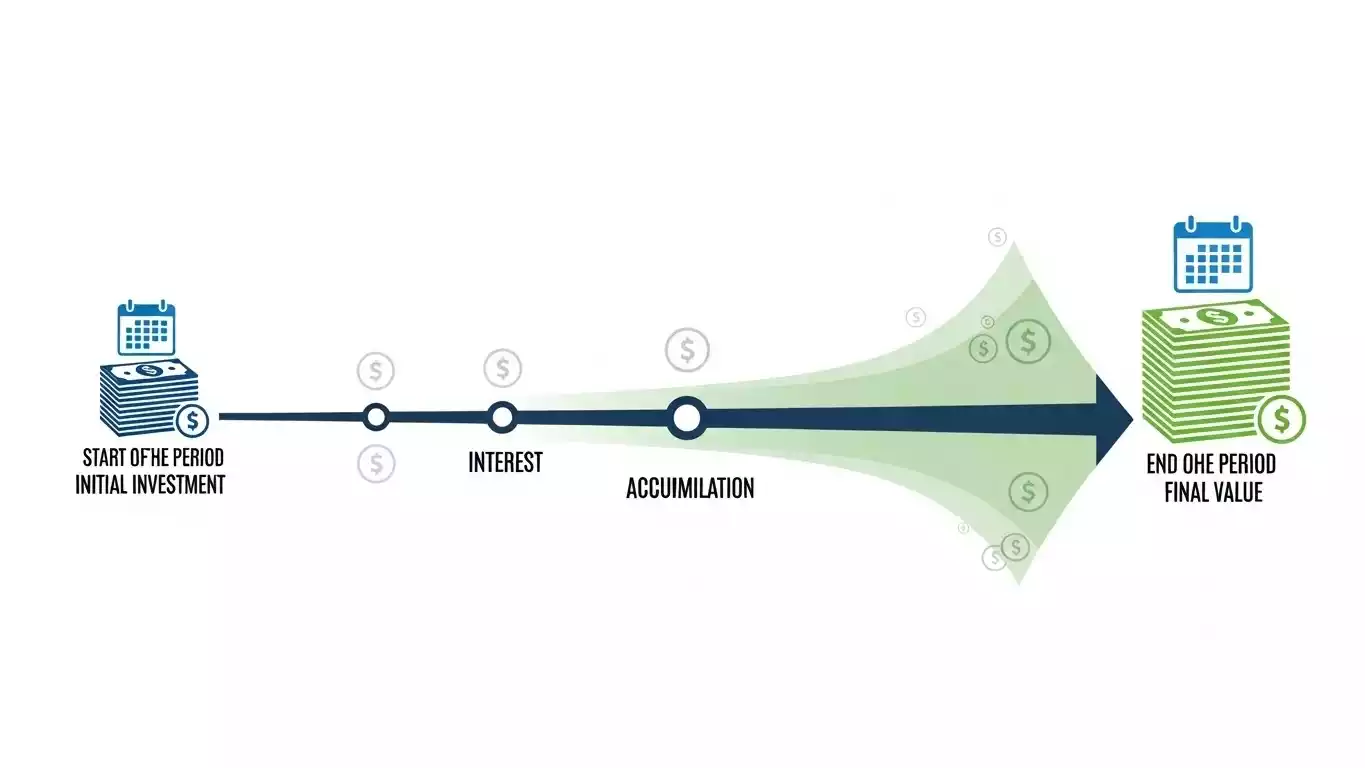

Why Timing Changes Everything

Let’s keep this practical.

If you invest $1,000 at the start of the year, it earns interest for the full year.

If you invest the same $1,000 at the end of the year, it earns nothing during that year.

Same amount. Same rate. Different result.

That’s why annuity due calculations always produce higher present and future values than ordinary annuity calculations.

What Is Present Value of an Annuity Due?

The present value (PV) of an annuity due shows how much all future payments are worth right now.

In simple words:

“If I receive these payments in the future, what are they worth today?”

This concept helps with decisions like:

- Buying a pension plan

- Evaluating lease contracts

- Comparing investment options

- Planning long-term savings

Financial professionals rely on present value to compare money across time.

What Is Future Value of an Annuity Due?

The future value (FV) of an annuity due shows how much your regular payments will grow into over time.

In plain English:

“If I keep paying this amount at the start of each period, how much will I have later?”

Future value calculations help with:

- Retirement planning

- SIP or recurring investment planning

- Education savings

- Long-term wealth building

This is where compound interest quietly does the heavy lifting.

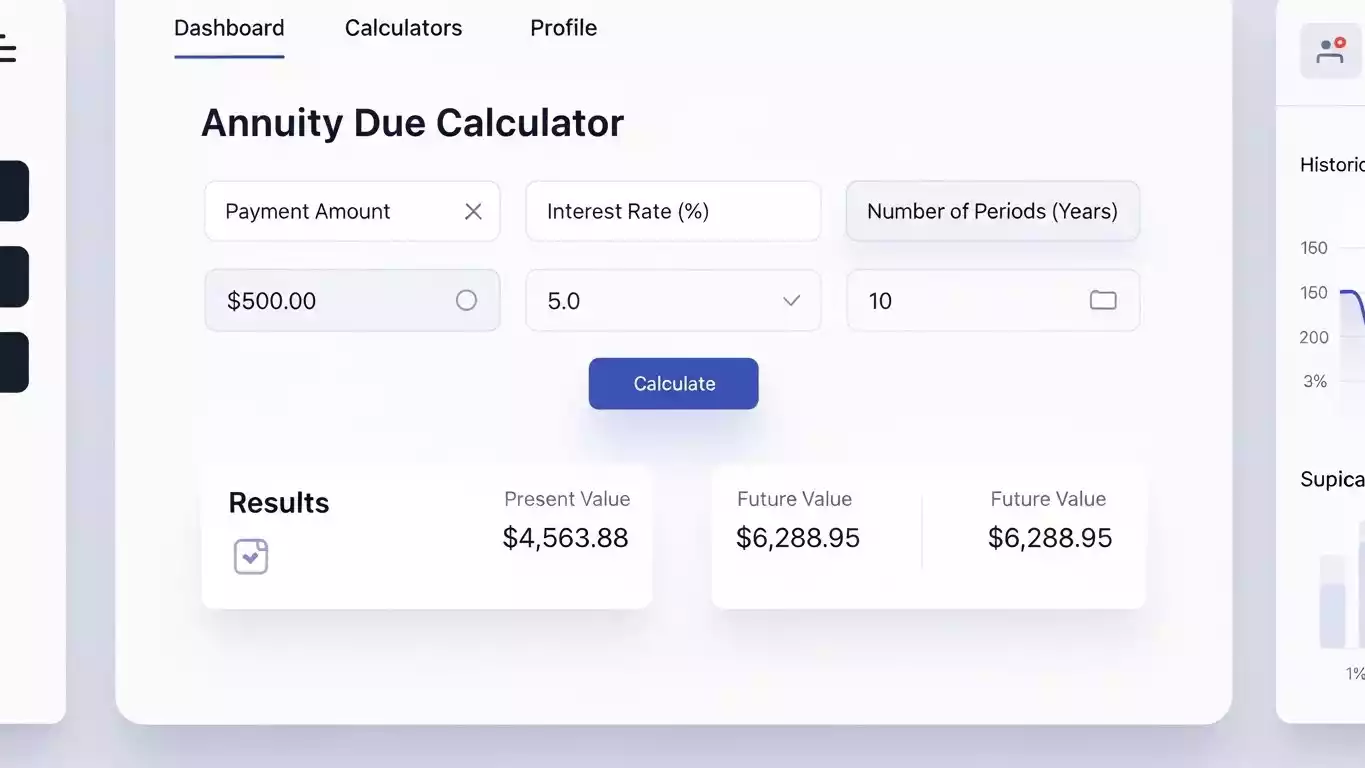

How an Annuity Due Present and Future Value Calculator Works

An Annuity Due Present and Future Value Calculator removes the headache of formulas and manual calculations.

You just enter:

- Payment amount

- Interest rate

- Number of periods

- Compounding frequency

The calculator instantly shows:

- Present Value of Annuity Due

- Future Value of Annuity Due

No spreadsheets, No math panic, No guessing.

Formula Logic (Explained Simply)

You don’t need to memorize formulas, but understanding the logic helps you trust the results.

An annuity due calculation works like an ordinary annuity calculation, then adds one extra period of interest.

Why?

Because payments occur at the beginning, not the end.

That single adjustment increases both present and future values-and that’s not theory. That’s math.

Real-World Use Cases That Actually Matter

Let’s skip textbook examples and focus on real decisions.

1. Rent and Lease Planning

If you pay rent upfront every month, you’re dealing with an annuity due.

A calculator helps landlords and tenants evaluate long-term lease value fairly.

2. Retirement Contributions

Many retirement plans deduct contributions at the start of the pay period.

An annuity due calculator gives a more accurate retirement estimate.

3. Insurance Premium Analysis

Annual insurance premiums paid in advance follow annuity due logic.

Calculators help compare policy costs over time.

4. Education Savings

Parents who deposit funds at the start of each year benefit from annuity due growth.

Time rewards early action. Finance never forgets that.

Why You Should Use a Calculator Instead of Manual Math

You can calculate annuity due values manually.

You shouldn’t.

Here’s why calculators win:

- Reduce calculation errors

- Save time

- Improve accuracy

- Allow instant comparisons

- Handle compounding correctly

Even financial analysts use calculators. It’s not laziness-it’s efficiency.

Accuracy, Trust, and Financial Standards

Annuity due calculations follow standard time value of money principles, widely accepted across finance, accounting, and economics.

These principles appear in:

- CFA curriculum

- MBA finance programs

- IRS financial guidelines

- Investment valuation models

Trusted educational platforms like Investopedia, Corporate Finance Institute (CFI), and financial textbooks by McGraw-Hill explain annuity due using the same logic used in calculators.

That consistency builds trust.

Common Mistakes People Make (And How to Avoid Them)

Even smart people mess this up. Here are the usual traps.

Confusing Payment Timing

If payments happen at the start, always choose annuity due-not ordinary annuity.

Ignoring Compounding Frequency

Monthly, quarterly, and annual compounding change results. Always match the frequency.

Overestimating Returns

Calculators show math, not guarantees. Markets don’t promise anything.

Skipping Inflation

Future value looks great until inflation joins the party. Plan realistically.

Is an Annuity Due Better Than an Ordinary Annuity?

Short answer: Yes, financially speaking.

Long answer: An annuity due benefits from earlier compounding. That advantage increases with time and interest rate.

However, the best choice depends on:

- Cash flow flexibility

- Payment obligations

- Investment goals

Math favors annuity due. Life sometimes doesn’t.

How This Calculator Helps With Better Decisions

A good Annuity Due Present and Future Value Calculator helps you:

- Compare investment options fairly

- Plan realistic savings goals

- Understand true payment costs

- Avoid emotional financial decisions

Numbers don’t lie. They just need the right context.

An annuity due involves payments made at the beginning of each period.

That timing increases both present and future value.

Using a calculator improves accuracy and decision-making.

This concept plays a key role in rent, insurance, retirement, and investment planning.

Finance doesn’t need to feel intimidating. Tools like this exist for a reason.

Frequently Asked Questions (FAQs)

What is an annuity due in simple terms?

An annuity due is a series of equal payments made at the beginning of each period instead of the end.

Is annuity due better than ordinary annuity?

Yes. Because payments happen earlier, annuity due earns more interest over time.

When should I use an annuity due calculator?

Use it whenever payments occur at the start of the period, such as rent, insurance premiums, or upfront investments.

Does compounding frequency matter?

Absolutely. Monthly compounding produces different results than annual compounding.

Can I use this calculator for retirement planning?

Yes. Many retirement contributions follow annuity due timing, making this calculator highly relevant.

Are annuity due calculations accurate?

Yes, when based on standard time value of money formulas used in finance education and professional analysis.

Do calculators consider inflation?

Most calculators do not adjust for inflation automatically. You should factor it in separately.

Final Thoughts

Money decisions improve when timing meets clarity.

The Annuity Due Present and Future Value Calculator gives you both.

It doesn’t predict the future.

It simply helps you understand it better.

And honestly? That’s already a huge advantage.