Making investment decisions without clear numbers feels like driving with your eyes closed. The Accounting Rate of Return Calculator helps you open those eyes. It gives a simple, accounting-based way to measure how profitable an investment could be.

This guide explains the Accounting Rate of Return (ARR) in plain English, with logic, examples, light humor, and real-world context. You will learn how ARR works, when to use it, when to avoid it, and how an ARR calculator saves time and mistakes.

What Is Accounting Rate of Return (ARR)?

The Accounting Rate of Return measures the expected profitability of an investment using accounting profits instead of cash flows. In simple words, it tells you how much profit an investment generates compared to the money invested.

Businesses often use ARR during early project evaluations because it feels familiar. It relies on numbers already available in financial statements, not complex finance models.

If ROI is the popular kid, ARR is the quiet class topper-simple, predictable, and easy to understand.

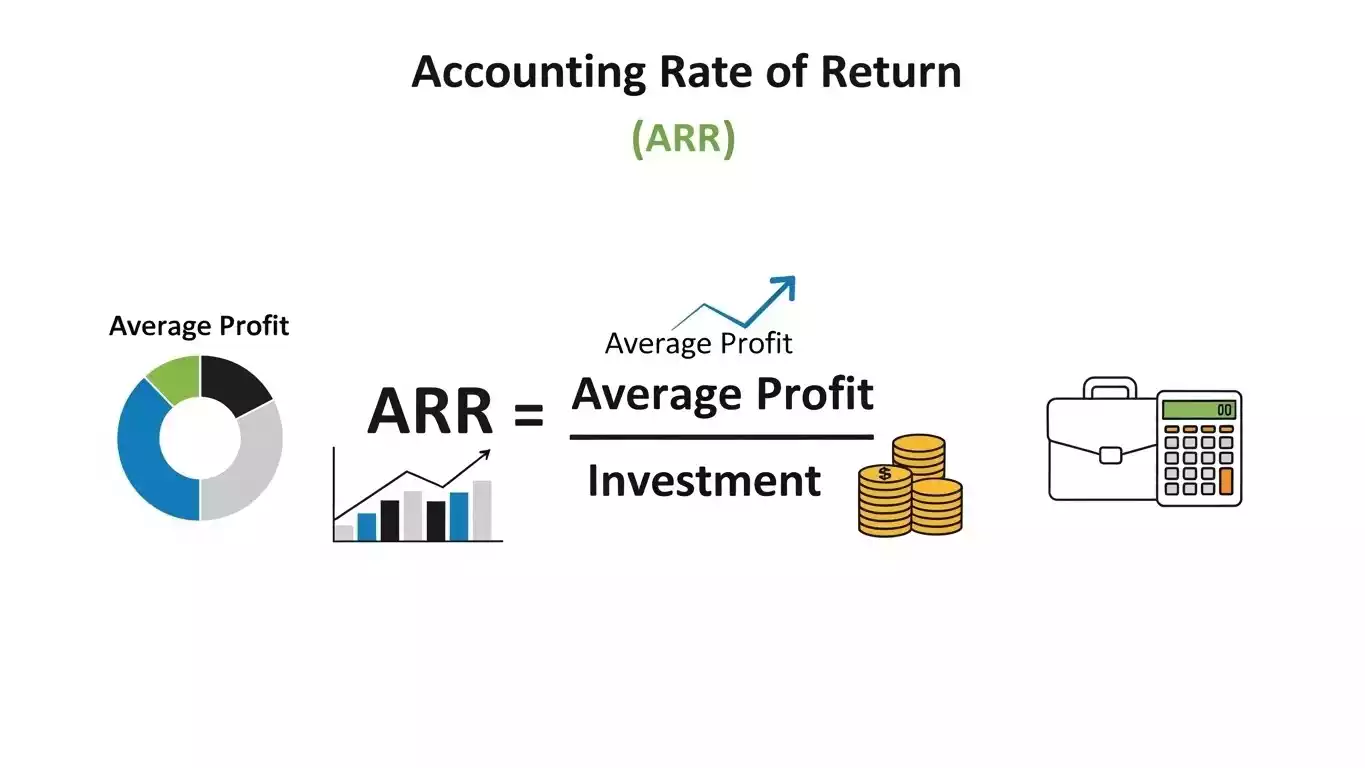

Accounting Rate of Return Formula

The ARR formula stays refreshingly simple:

Accounting Rate of Return = (Average Annual Accounting Profit / Initial Investment) × 100

Some companies replace initial investment with average investment, depending on internal policies. Both versions remain acceptable as long as you stay consistent.

Key Terms Explained

- Average Annual Profit: Net profit after depreciation and tax.

- Initial Investment: Total capital spent to start the project.

- Average Investment (optional): (Initial Investment + Salvage Value) ÷ 2.

The calculator handles these calculations instantly, so you avoid manual errors.

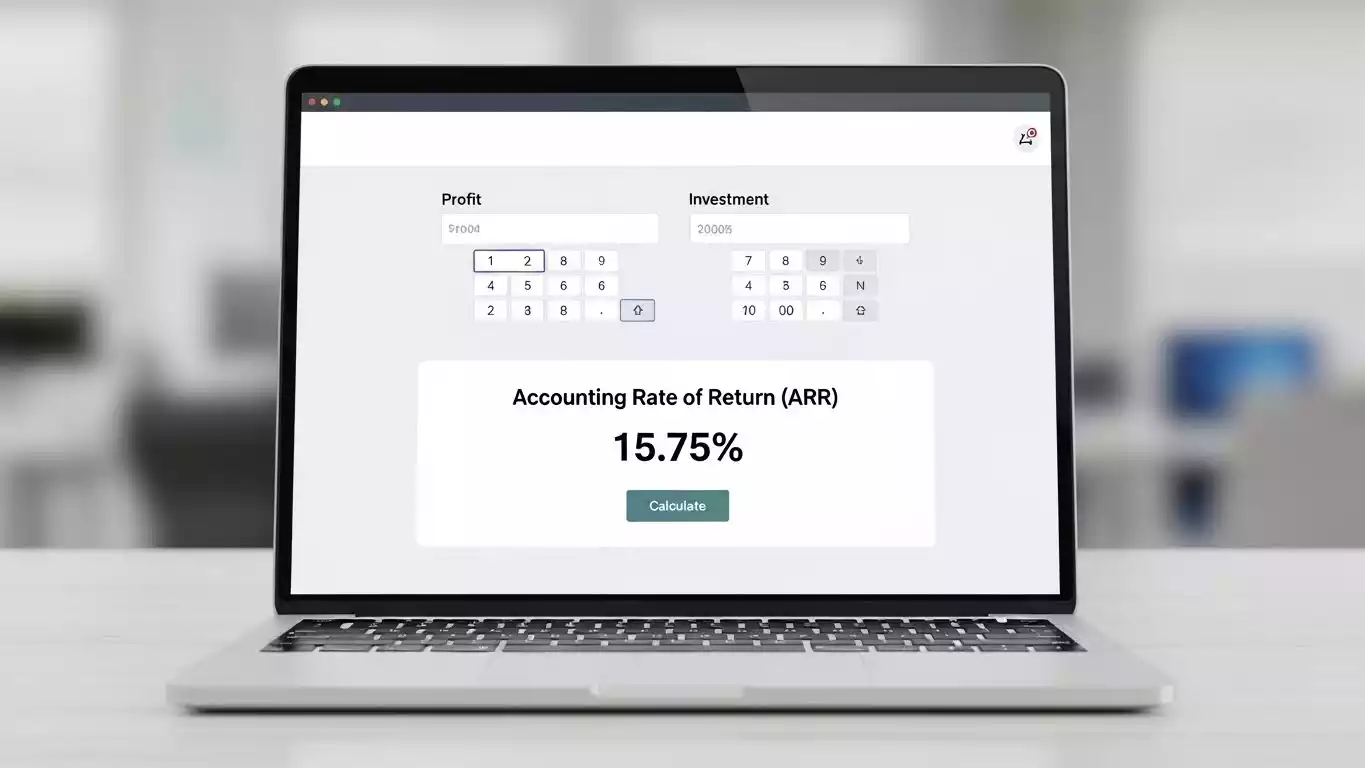

What Is an Accounting Rate of Return Calculator?

An Accounting Rate of Return Calculator automates the ARR formula. You enter basic financial values, and it instantly shows the ARR percentage.

This tool helps:

- Business owners evaluating new projects

- Students studying capital budgeting

- Finance professionals doing quick comparisons

No spreadsheets, No formulas to memorize, No calculator-induced stress.

How to Use an Accounting Rate of Return Calculator

Using an ARR calculator takes less time than making coffee.

Step-by-Step Process

- Enter the initial investment amount.

- Add expected average annual profit.

- Include salvage value if required.

- Click calculate.

The calculator instantly displays the Accounting Rate of Return as a percentage.

Short steps. Clear output. Zero confusion.

Practical Example of Accounting Rate of Return

Let’s make this real.

A company invests $100,000 in a new machine. The machine generates an average annual profit of $20,000.

ARR = (20,000 ÷ 100,000) × 100 = 20%

This means the project returns 20% of the investment annually in accounting profit.

If your company requires a minimum ARR of 15%, this project passes the test.

For investors comparing company performance, the Dividend Yield Calculator is often used alongside Accounting Rate of Return to evaluate how much income a stock generates relative to its price.

Why Businesses Use Accounting Rate of Return

ARR survives because it solves real problems.

Key Advantages

- Easy to calculate and understand

- Uses accounting data already available

- Works well for quick project screening

- Helps non-finance teams participate in decisions

ARR speaks the language of profit, not financial theory.

Limitations of Accounting Rate of Return

ARR looks simple, but it has blind spots.

Major Drawbacks

- Ignores the time value of money

- Focuses on profit, not cash flow

- Can mislead long-term investment decisions

- Accounting policies can affect results

ARR works best as a starting point, not a final verdict.

While Accounting Rate of Return focuses on accounting profit, tools like the Compound Interest Calculator help investors understand how money grows over time by considering compounding effects, which ARR completely ignores.

ARR vs Other Investment Evaluation Methods

Understanding ARR becomes easier when you compare it with other methods.

ARR vs Net Present Value (NPV)

- ARR uses accounting profit

- NPV uses discounted cash flows

- NPV considers time value of money

ARR vs Internal Rate of Return (IRR)

- ARR is simple and static

- IRR is dynamic and more accurate

- IRR suits long-term projects better

Accounting Rate of Return wins on simplicity. Advanced methods win on precision.

Unlike ARR, which does not adjust for time value of money, the Discount Factor Calculator is commonly used in advanced financial analysis to convert future returns into present value for better decision-making.

When Should You Use an Accounting Rate of Return Calculator?

Use an ARR calculator when:

- You want quick project comparisons

- Cash flow data is unavailable

- Management prefers profit-based metrics

- You need a teaching or learning tool

Avoid ARR when evaluating complex or long-term investments.

Accounting Rate of Return in Real Business Decisions

ARR appears in:

- Manufacturing expansion plans

- Equipment replacement decisions

- Small business capital budgeting

- Academic finance case studies

Its strength lies in clarity. Decision-makers can discuss ARR without decoding finance jargon.

How Accurate Is Accounting Rate of Return?

ARR remains accurate within its limits. It reflects accounting reality, not economic reality.

Accounting profits follow rules set by standards like GAAP and IFRS. These standards ensure consistency but do not capture timing of cash.

ARR answers one question well:

“How profitable does this investment look on paper?”

Many businesses also review operational performance using the EBITDA Calculator, as it removes non-operating expenses and provides a clearer view of profitability than Accounting Rate of Return alone.

Tips to Use ARR More Effectively

You can improve ARR decision quality by following these tips:

- Use consistent accounting methods

- Compare ARR against a preset benchmark

- Combine ARR with cash-flow methods

- Avoid relying on ARR alone

ARR works best as part of a toolkit, not a solo act.

Before relying on Accounting Rate of Return, businesses often analyze production efficiency using a Marginal Cost Calculator to understand how additional output impacts overall profitability.

Common Mistakes While Calculating ARR

Even simple metrics invite mistakes.

Watch Out For These Errors

- Ignoring depreciation assumptions

- Mixing average and initial investment

- Comparing ARR across different accounting policies

- Using ARR for mutually exclusive long-term projects

A calculator reduces errors, but logic still matters.

Accounting Rate of Return Calculator for Students

Students love ARR because:

- The formula stays simple

- Exam questions often include it

- Results feel intuitive

Using an online calculator helps verify answers and build confidence.

Is Accounting Rate of Return Still Relevant Today?

Yes, but with context.

Modern finance prefers NPV and IRR. Still, ARR remains popular in small businesses, education, and quick evaluations.

Think of ARR as a pocket knife-not a full toolbox, but always handy.

Frequently Asked Questions (FAQs)

What is a good Accounting Rate of Return?

A good ARR depends on business goals and risk tolerance. Many companies set a minimum ARR between 12% and 20%, based on industry standards.

Does ARR consider the time value of money?

No. ARR ignores the time value of money, which limits its accuracy for long-term projects.

Can ARR be negative?

Yes. If a project produces losses instead of profits, the ARR becomes negative.

Is ARR better than ROI?

ARR and ROI serve different purposes. ARR focuses on accounting profit, while ROI often considers total returns. Neither replaces detailed financial analysis.

Should small businesses use ARR?

Small businesses often use ARR because it stays simple and relies on existing accounting data.

Trusted References and Standards

The concepts explained in this article align with recognized accounting and finance standards, including:

- Corporate Finance textbooks by Pearson and McGraw-Hill

- International Financial Reporting Standards (IFRS)

- Generally Accepted Accounting Principles (GAAP)

- Financial management resources from Investopedia and corporate finance institutes

These sources ensure accuracy, consistency, and professional reliability.

Final Thoughts

The Accounting Rate of Return Calculator offers a clean and logical way to evaluate investment profitability. It keeps calculations simple, understandable, and accessible.

ARR may not predict the future perfectly, but it explains the present clearly. Used wisely, it strengthens early-stage decision-making and builds financial confidence.

If finance ever feels overwhelming, ARR reminds you that sometimes, simple math still matters.